Contents:

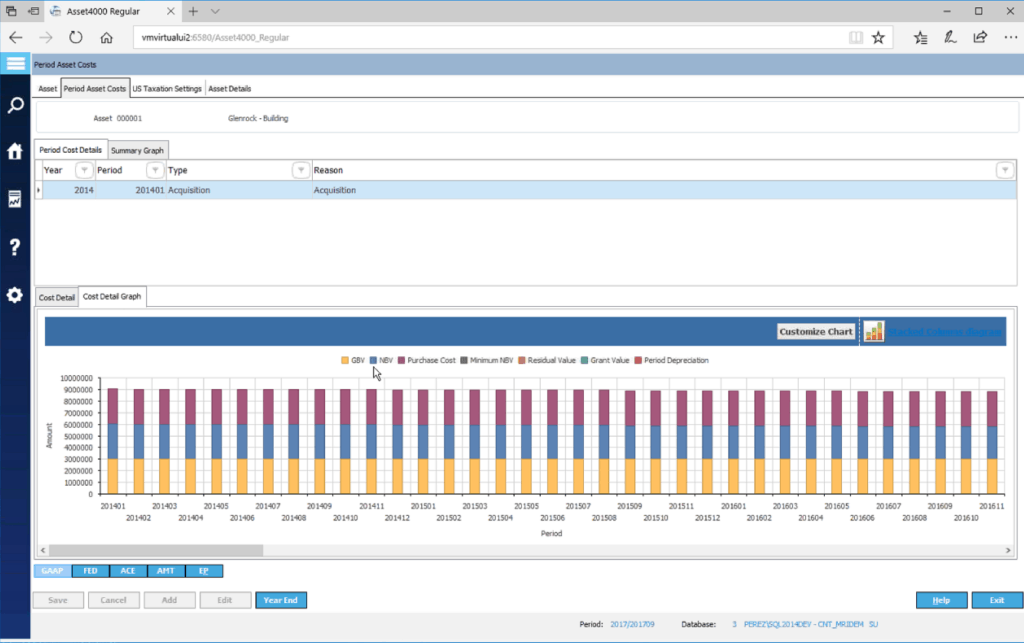

Evernote is a general-purpose tool for saving your electronic ‘stuff’. If you already use Evernote, it might be tempting to use it to store your receipts, especially as the premium and business accounts include OCR, which lets you search by the contents. Finally, the transactions are transferred to your accounting software – this involves varying degrees of automation. Where two cloud services are involved you may find it occurs with the click of a button once the setup process has been completed. Otherwise it may be necessary to export a file and then import it into your accounting software. Although you may need to invest more money to use a digital system, software does allow you to go paperless.

Just find a good bookkeeping Excel template and make sure to update it at least once a week. Receipt Bank lets you digitize and store your receipts in pretty much any way imaginable. You can do it using a mobile app, via web browser, via email, or automatically by hooking your credit card up to the app. It also automatically imports receipts from PayPal and Dropbox, and lets you take photos of multiple receipts at a time. If you work remotely or regularly have meetings in different parts of the world, you know post-trip expense tracking is a nightmare.

If your business does not need to store many receipts, use envelopes instead. Label each envelope and place them in a smaller filing system or folder. For example, you may dedicate a folder to company vehicle-related receipts. Jason Ding is a seasoned accountant with over 15 years of progressive experience in senior finance and accounting across multiple industries. Jason holds a BBA from Simon Fraser University and is a designated CPA. Jason’s firm, Notion CPA, is an accounting firm with a business-first focus.

Everything can also be organized by date, the location the items were purchased, or the type of items purchased. If you keep the folder names short and easy to read, it will make your receipt tracking so much easier later on. Invest in a small scanner that you can run your old receipts through.

It’s Really Quite Simple: Republicans Hate Young People.

Posted: Sat, 15 Apr 2023 10:00:50 GMT [source]

Receipt scanning apps photograph and create digital versions of your receipts, which you can easily retrieve from a digital filing system. The root of this problem is that many people just don’t know which receipts they need to keep for tax time. Today’s article will walk you through which receipts you need (and which ones you don’t!) when completing your taxes. Some scanners and multifunction printers include the capability to scan directly into Evernote without going through a computer. This is particularly convenient if you scan a lot of paper documents.

There are add-on products that provide a degree of integration between Evernote and accounting systems, but few of those we found are relevant to the specific task of handling receipts. For example, Zapier can create a Xero invoice from an Evernote note, and the company is considering Saasu integration. There is also an app called Expensify which automatically copies new images added to an Expensify notebook to Evernote, which would be convenient if you prefer keeping all your stuff in one place. While this sounds primitive, if your scanning software performs OCR when producing PDF files then the operating system’s built-in search facility can be used to find particular files. A small improvement on this method is systems that automatically deposit scans into a series of subfolders, one for each day. Depending on your small business needs, you may even wish to organize the document by purchase date or vendor.

I think it’s really important to look at your unique business instead of following one specific rule of thumb for organizing your receipts. With that said, color coding and using labels are both really helpful for keeping business receipts and documents organized. Neat also works with the most popular bookkeeping softwares to make the organizing process so much easier.

Is money management and accounting for your small business not really your thing? If you’ve got a large or quickly-growing business with a lot of paperwork to deal with, you might consider investing in a dedicated business document scanner, like the Kodak Alaris. Due to the Period of Limitations, the IRS also technically requires you to hold on to receipts for significant expenses (i.e. larger than $75) for at least three years.

For example, with online banking statements, even if the company prints out the statement itself, it is still an external document, as it was created and provided by an external party. Furthermore, an invoice sent by mail also counts as an external document, even if it is printed independently. If a purchase invoice is issued digitally, it should include an authentic electronic signature, otherwise the receipt cannot be used to claim input tax credits. If in doubt, it’s always possible to request an original receipt in paper. If your business is very small, or if you don’t have many receipts, use an envelope for each type of expense rather than files and folders. For instance, if you’re keeping track of household expenses, you can sort your receipts into categories like groceries, gas money, clothing, and other necessities.

A $19.99 per year pro account can be linked with up to 10 free or pro accounts. DocketBank is more of an expense management system than just a way of getting expenses into your accounting system and keeping images of individual dockets. Businesses should keep business receipts for at least three years in case of an audit. Some companies may prefer to store receipts for a longer period, such as seven years.

The IRS is coming for crypto — but it’s complicated.

Posted: Mon, 05 Dec 2022 08:00:00 GMT [source]

Using change in net working capital means you can stop stuffing receipts into your luggage while you’re on the go. Snap pictures of your paper receipts with your mobile device, submit and be done with them. Digitize all of your receipts so that you can easily organize and find them on your computer when it’s tax time.

But if you’re looking for an app that can ingest a lot of receipts quickly, in every way imaginable, Receipt Bank is the app for you. Receipt Bank also integrates with most popular accounting software, including Xero, QuickBooks, FreshBooks and Sage One. But if you’re a QuickBooks pro, have a dedicated admin employee who’s willing to learn, and already use QuickBooks for your accounting, it’s definitely a worthy option. Keep all receipts for a minimum of three years after filing your tax return. The video where Trump Jr. is praising Winston Wolkoff also happens to be at an inauguration event that Junior also didn’t recall attending. Prosecutors have receipts for all of these expenditures and whether or not it matters if Junior is lying or simply an ignoramus, will be a legal question decided by the courts .

If your device doesn’t have this capability, it’s usually possible to direct scans to a particular folder or application on the computer in order to get the images into Evernote. Some receipt applications or services incorporate approval and reimbursement processes. That can be a convenience, but you may prefer to handle those tasks within your accounting software. 194 woman with a pile of receipts royalty-free stock photos and images found for you. If you don’t want to pay for software or a scanner, you can take pictures of your receipts. Then, manually upload them to your computer for safekeeping and organization.

Or maybe you’re just trying to reimburse an employee for an expensive Uber ride they had to take. Use this filter to customize your preferences for AI-generated images. Select to view only AI-generated images or exclude them from your search results.

You might have to do that manually or it could be done automatically (using Optical Character Recognition – OCR), like softwre that scans business cards. We’d argue accuracy is even more important when it comes to receipts, so we think having someone verify the information after it’s scanned is important. Folders, files, and storage cabinets are great ways to keep receipts safe and accessible.

Washington, D.C. Attorney General Karl Racine filed a civil complaint against the Trump Organization and the Presidential Inaugural Committee. Racine alleged that these two Trumpian groups acted a lot like money laundering operations. The news cycle during the last White House administration was a never-ending stream of corruption and nepotism. The Trumps participated in such transparent acts of self-dealing and corruption that it became clear they believed their positions in government would immunize them from any prosecution of their actions.

Your ultimate decluttering checklist – 50+ things to get rid of right now.

Posted: Sat, 22 Apr 2023 08:00:28 GMT [source]

And you can turn paper receipts into digital receipts to organize everything together. If you’re already an Evernote user, you’ll definitely want to check out receipts. If you’re like many of my clients, part of the dread of tax time is sorting through a pile of receipts you’ve thrown in a box or drawer somewhere. ” As such, it aims to be a complete expense system that captures scanned, photographed or natively-digital receipts, and managing the approval process through to reimbursement.

This means you cannot have a scan of a torn receipt or a cut-off scan that does not show all of the information included in the original. Plus, switching to digital records for receipt files can reduce paper clutter. Everything can get easily accessed through your mobile phone or computer at the click of a button. So when you need to do your tax return, or you need to quickly find a receipt, you will know exactly where everything is. Here are the 6 best ways for you to organize your receipts electronically.

Monthly plans start at $19 for 25 credits, or you can buy blocks of credits with six-month validity from $119 for 150 credits. Invitbox is intended to save you the trouble of manually entering your suppliers’ invoices into an accounting system. If you are using it for that purpose you can also take advantage of it for expense receipt processing and storage.

Recept Bank also offers a free service for those who don’t mind looking after the data entry and just want to be able to submit, store and export receipts. Once a receipt has been captured and transcribed by ExpenseMagic it can be automatically transferred to Xero so the expense appears in the accounts. If you don’t want to pay you can still use the ExpenseMagic app, but you’ll have to enter the details manually. The high end of the service is a corporate account for at least five users ($7.49 per user per month).